Though some buyers are currently well versed in monetary metrics (hat idea), this post is for those people who would like to find out about Return On Fairness (ROE) and why it is vital. By way of learning-by-carrying out, we will appear at ROE to gain a superior comprehending of Marriott Vacations Throughout the world Company (NYSE:VAC).

Return on Equity or ROE is a check of how correctly a corporation is growing its price and managing investors’ dollars. In limited, ROE displays the revenue each individual dollar generates with regard to its shareholder investments.

See our latest assessment for Marriott Holidays Throughout the world

How To Determine Return On Fairness?

The method for return on fairness is:

Return on Fairness = Net Financial gain (from continuing operations) ÷ Shareholders’ Fairness

So, primarily based on the over system, the ROE for Marriott Vacations Worldwide is:

14{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} = US$362m ÷ US$2.6b (Dependent on the trailing twelve months to September 2022).

The ‘return’ is the gain more than the very last twelve months. Just one way to conceptualize this is that for each and every $1 of shareholders’ money it has, the firm created $.14 in financial gain.

Does Marriott Holidays Throughout the world Have A Fantastic ROE?

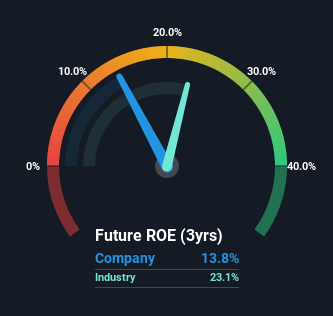

Arguably the least difficult way to assess company’s ROE is to evaluate it with the average in its business. Nevertheless, this system is only practical as a tough examine, due to the fact corporations do vary rather a little bit within just the similar industry classification. As proven in the graphic underneath, Marriott Vacations Around the globe has a reduced ROE than the regular (23{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}) in the Hospitality business classification.

That surely is not suitable. That being stated, a low ROE is not constantly a poor factor, particularly if the company has very low leverage as this nevertheless leaves area for improvement if the firm had been to choose on much more financial debt. When a business has low ROE but higher personal debt levels, we would be cautious as the risk involved is much too high. To know the 2 pitfalls we have identified for Marriott Vacations Worldwide pay a visit to our risks dashboard for cost-free.

How Does Debt Affect ROE?

Nearly all providers want revenue to spend in the business enterprise, to increase earnings. That funds can come from retained earnings, issuing new shares (equity), or personal debt. In the scenario of the to start with and 2nd possibilities, the ROE will mirror this use of income, for advancement. In the latter scenario, the use of debt will improve the returns, but will not change the equity. That will make the ROE glance improved than if no financial debt was made use of.

Combining Marriott Holidays Worldwide’s Debt And Its 14{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} Return On Equity

It can be really worth noting the higher use of personal debt by Marriott Vacations Around the world, foremost to its debt to equity ratio of 1.70. When its ROE is rather respectable, the volume of credit card debt the corporation is carrying at the moment is not perfect. Buyers must imagine carefully about how a firm might carry out if it was not able to borrow so conveniently, since credit markets do adjust around time.

Summary

Return on fairness is a beneficial indicator of the ability of a enterprise to deliver gains and return them to shareholders. A enterprise that can achieve a high return on fairness devoid of personal debt could be considered a higher high-quality business. All else currently being equivalent, a bigger ROE is far better.

But ROE is just one piece of a greater puzzle, due to the fact high high-quality companies normally trade on superior multiples of earnings. It is essential to contemplate other components, these kinds of as foreseeable future income growth — and how much investment is needed likely forward. So you may want to get a peek at this information-rich interactive graph of forecasts for the business.

If you would choose check out a different business — just one with potentially remarkable financials — then do not miss out on this absolutely free record of intriguing businesses, that have Superior return on equity and minimal personal debt.

What are the threats and options for Marriott Vacations Around the globe?

Marriott Holidays All over the world Corporation, a getaway firm, develops, markets, sells, and manages trip ownership and related solutions.

View Total Investigation

Rewards

-

Value-To-Earnings ratio (14x) is beneath the US industry (14.3x)

-

Earnings are forecast to grow 17.86{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} for each yr

-

Grew to become worthwhile this 12 months

Pitfalls

-

Debt is not effectively covered by running funds circulation

Perspective all Risks and Benefits

Have suggestions on this article? Involved about the material? Get in touch with us specifically. Alternatively, email editorial-workforce (at) simplywallst.com.

This write-up by Simply Wall St is typical in mother nature. We deliver commentary dependent on historical knowledge and analyst forecasts only applying an unbiased methodology and our content are not meant to be fiscal assistance. It does not constitute a recommendation to buy or sell any inventory, and does not just take account of your aims, or your fiscal scenario. We goal to convey you very long-term centered analysis pushed by essential knowledge. Be aware that our assessment may perhaps not issue in the newest price-sensitive corporation announcements or qualitative product. Only Wall St has no position in any shares described.

More Stories

24 Gorgeous Vacation Spots To Choose If You JUST Want To Relax

39 best family vacation spots perfect for kids in 2023

19 Top Overwater Bungalows Around the World