Thomas Barwick/DigitalVision via Getty Images

The timeshare industry was one of those massively affected by pandemic restrictions. And even a giant like Marriott Vacations Worldwide Corporation (NYSE:VAC) was no exception. But the company proved why it remained one of the most formidable figures in the industry. More than two years later, it has rebounded to pre-pandemic levels. Today, it stays strategic with its operations to cope with macroeconomic volatility and travel trend changes. Its operations stayed fruitful, with impressive revenue growth and well-managed margins. Also, its decent financial positioning shows it can cover its operating capacity. It must be careful, though, given the substantial increase in borrowings amidst interest rate hikes.

Meanwhile, dividends have been consistently increasing since it resumed its payments. It maintains decent yields compared to the market average. However, VAC comes at a high stock price.

Company Performance

The past three years have been disruptive for the timeshare industry. Hotels, resorts, and vacation properties were deemed non-essential amidst pandemic disruptions. As such, they faced limited operations and demand due to the recession and travel restrictions. Even an established company like Marriott Vacations Worldwide Corporation did not avert the unfavorable impact. But recovery has been sweet for the company in the next two years.

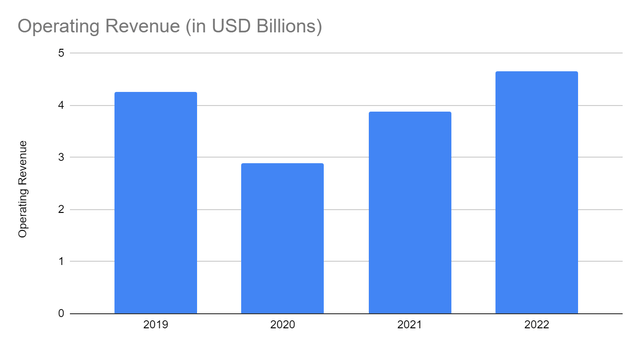

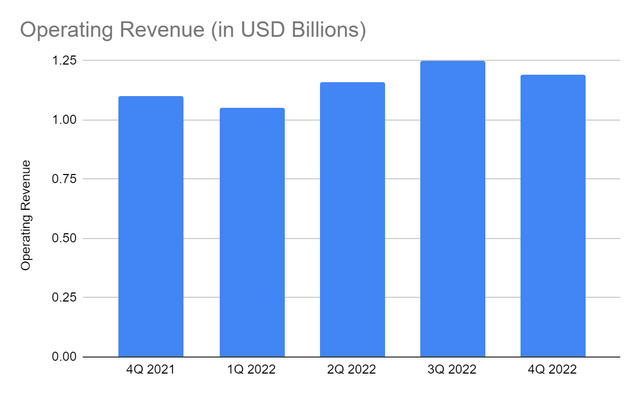

The operating revenue of Marriott amounted to $4.66 billion, a 20{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} year-over-year growth. Even better, it has already surpassed pre-pandemic levels, showing its continued recovery. It also maintained a solid customer base despite inflationary headwinds. Indeed, Marriott had a fruitful 2022 with increased sales. Various company growth drivers must be highlighted.

Operating Revenue (MarketWatch)

Operating Revenue (MarketWatch)

One of these is the current timeshare renaissance. Let’s face it. Timeshares have always been more popular with Baby Boomers and Gen Xs. The rise of booking apps in hotels and vacation rentals hampered its potential. But now, the timeshare industry is making a comeback. In a study in different parts of the world, Millennials and Gen Zs now comprise 57{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} of timeshare owners. Timeshares continue to evolve to keep up with the changing market needs and preferences. For instance, revamped-point-based systems of increased travel plan flexibility among members. Booking a timeshare and arranging everything in a single place is already convenient. So members and renters will not have to check multiple reservation websites and systems. With that, it became a top option for young people. Timeshares are also favorable for those who work remotely. They serve as a home away from home, a place to relax without the hassles of hotels and vacation rentals.

Revenge travel was also a primary driving force. Although consumer behavior can’t always be quantified, travel interests peaked in 2022 despite inflation. In a study, travel searches in 2022 exceeded 2019 levels. Even the tourism industry dealt with labor bottlenecks due to a massive influx of travelers that outnumbered staff. Marriott benefited from this trend, leading to 20,000 new members.

Strategic pricing also helped the company maximize its potential. It worked amidst the rising prices and travel demand. The impact was more visible in the second half as prices rose. The operating revenue in 4Q amounted to $1.19 billion, an 8{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} year-over-year growth. It was lower than in 3Q, but it was logical. The third quarter is often the travel peak due to seasonality. The near-term impact of higher prices was also greater in the quarter. Also, moderating demand across industries also contributed to the decrease from 3Q to 4Q. We can see it in the 4Q VPG of $4,088 versus the 2022 average of $4,421. But overall, VAC’s 2022 performance was robust.

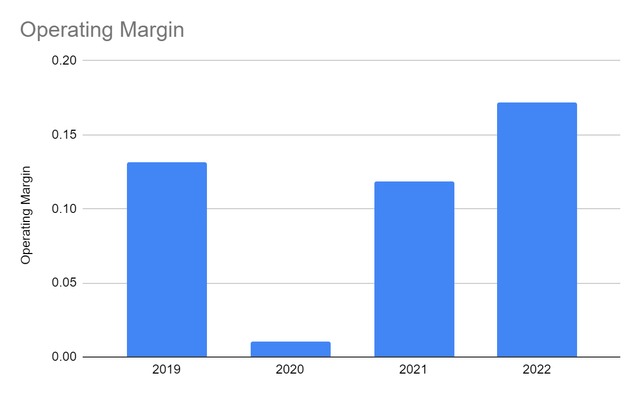

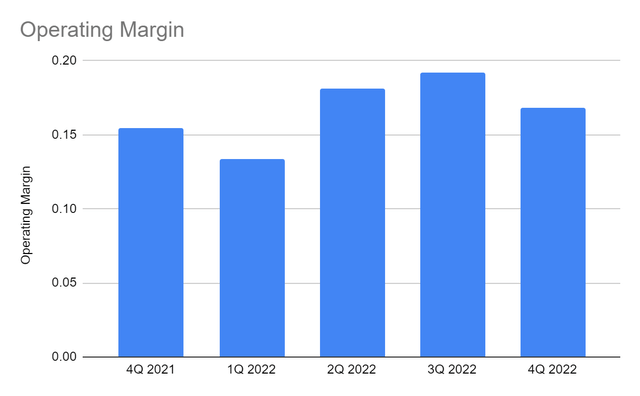

But what made VAC’s performance even better was its success at stabilizing costs and expenses. They increased proportionately to the operating revenue, showing increased efficiency amidst inflation. We can also understand that increased prices and demand offset the impact of costs and expenses. With that, the operating margin reached 17{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} versus 13{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} in 2019 and 12{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} in 2021. In 4Q 2022, it was 17{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} versus 15{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} in 4Q 2021.

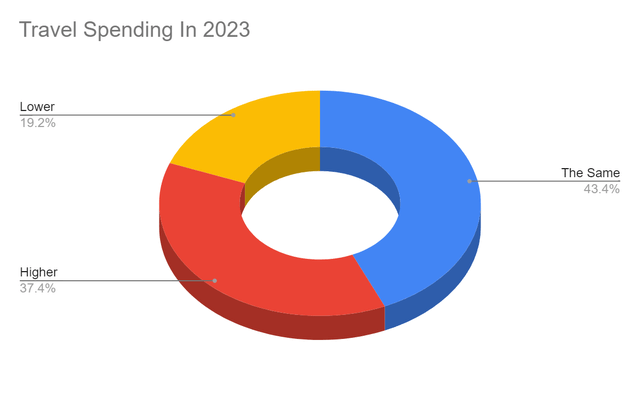

Travel Spending In 2023 (CNBC)

Travel Spending In 2023 (CNBC)

The company is still a household name, allowing it to expand and capture more customers. Also, timeshares see attractive growth prospects despite the moderating business and leisure travel demand. VAC may capitalize on its solid customer base and popularity to maintain its operating capacity. I will discuss more of its potential trends in the next section.

Why Marriott Vacation Worldwide Corporation May Remain A Solid Company This Year

Inflationary headwinds are still challenging across industries, given the moderating demand. Tourism is no exception since travelers feel the burden of rising prices. In a 2022 survey, over 80{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} of Millennial and Gen Z travelers said inflation strained their budget. As such, many people anticipate an earlier end for revenge travel. Industry performance may be affected since consumers may have to adjust to higher prices.

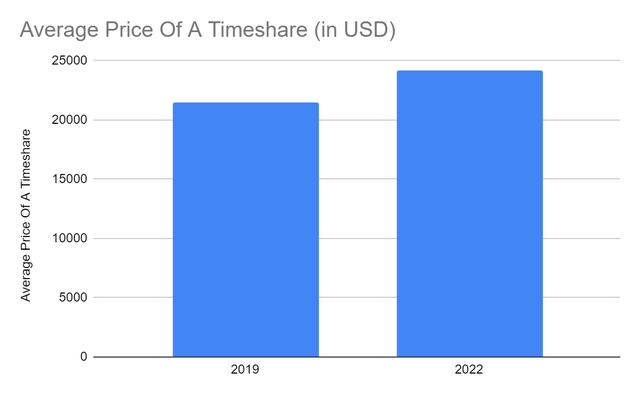

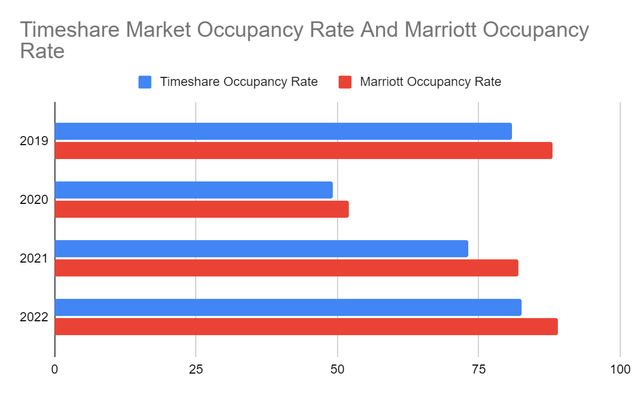

On a lighter note, most travelers preferred to change their itineraries to shorter and domestic trips. And 4Q 2022 had a sprinkle of hope for travel and tourism. We can attribute it to inflation dropping to 6.5{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} when the year ended. In January, it further slowed down to 6.4{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}. I expect prices to decrease more as the Fed keeps its conservative approach to economic stability. If it continues, timeshares may maintain their current prices and occupancy rates, especially during peak seasons. Timeshare prices went up from $21,455 in 2019 to $24,140 in 2022. Despite this, occupancy rates rose to 82.6{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} in 2022 and exceeded pre-pandemic levels of 80.8{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}. Again, Marriott proved its solid positioning, given its above-market average rate of 88{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} and 89{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}. Even better, a survey shows that over 80{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} of travelers plan to spend the same or higher on travel and tourism. It is consistent with the forecast of The Economist, which showed increased travel spending across regions. It is possible as the US inflation continues to relax.

Average Price Of A Timeshare (American Resort Development Association)

Timeshare Market And Marriott Occupancy Rate (American Resort Development Association And Marriott 4Q Investor Presentation)

Travel Spending In 2023 (CNBC)

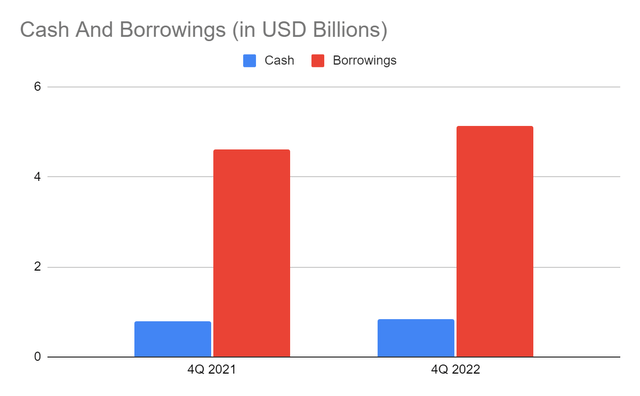

Marriott can keep up with these changes and sustain its capacity with its decent liquidity position. Its cash levels are still adequate and increasing while covering operations and liabilities. Yet, it has to beware of its borrowings, which are already five times the amount of cash. Thankfully, its Net Debt/EBITDA Ratio of 4.1x is still below the maximum of 4.5x. It is acceptable for capital-intensive companies, which may require more financial leverage. With that, the company is still earning enough to cover borrowings. We can confirm it with its cash flow from operations that can cover CapEx. But the estimated ratio may convey that the company must limit its borrowings to maintain liquidity.

Cash And Equivalents And Borrowings (MarketWatch)

Stock Price

The stock price of Marriott Vacations Worldwide Corporation increased sharply from its 2020 levels. But it slowed down in 2022 when it had corrections. At $154.05, it is only 4{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} higher than last year’s value. Despite this, the stock price does not appear cheap relative to fundamentals. Using the PB Ratio, the company has a BVPS of 66.74 and a PB Ratio of 2.36x. It is way lower than the yearly average of 1.92x. If we multiply the current BVPS by the average PB Ratio, the target price will only be $128.07.

Meanwhile, dividends have kept increasing since Marriott resumed its payments. Dividend yields are decent at 1.95{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}, higher than the S&P 400 of 1.5{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}. These are also well-covered, given the Dividend Payout Ratio of 31{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}. To assess the stock price better, we will use the DCF Model.

FCFF $410,000,000

Cash $854,000,0000

Borrowings $5,140,000,000

Perpetual Growth Rate 4.8{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}

WACC 9.2{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be}

Common Shares Outstanding 37,481,000

Stock Price $154.05

Derived Value $131.11

The derived value can confirm the supposition of potential overvaluation. There may be a 16{8ac304f283d9048aa406820cdb3efba1388565cefcdaf9ad6f054e81ea9085be} downside in the next 12-18 months. So, investors must watch out for a potential decrease before buying stocks.

Bottomline

Marriott Vacations Worldwide Corporation secures the top position in the industry. It should not be surprising, given its solid performance amidst market volatility. It may sustain its capacity with its adequate cash reserves, although it must work on minimizing borrowings. Also, market prospects for travel and timeshares are still sunny despite inflation uncertainties. Meanwhile, dividend payments continue to increase with reasonable yields and payout ratio. But the stock price is too high for its fundamentals. The recommendation is that Marriott Vacations Worldwide Corporation is a hold.

More Stories

24 Gorgeous Vacation Spots To Choose If You JUST Want To Relax

39 best family vacation spots perfect for kids in 2023

19 Top Overwater Bungalows Around the World